All Categories

Featured

Table of Contents

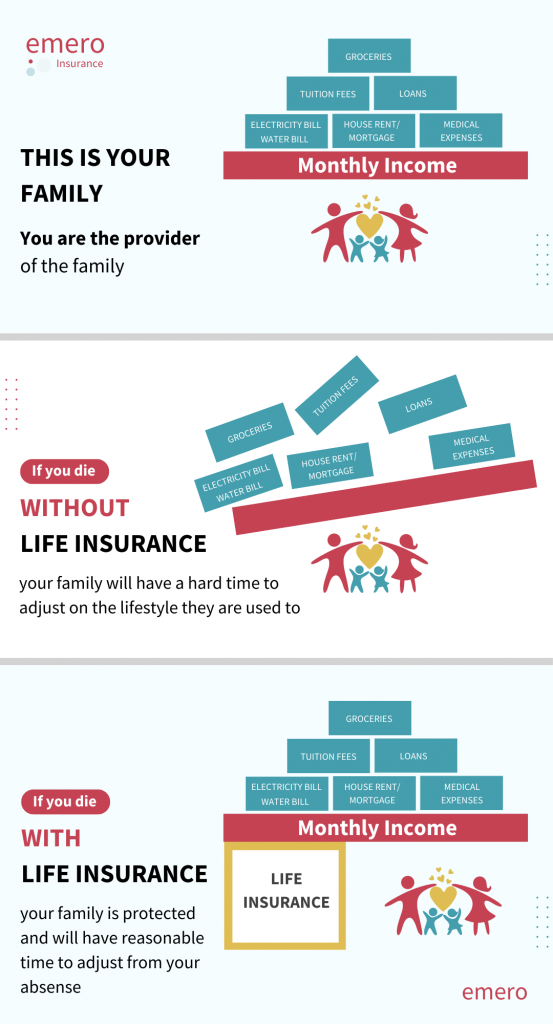

Life insurance coverage aids make sure that the monetary debt you owe towards your home can be paid if something takes place to you. It makes sense to have a plan in place making certain that your family members will be able to maintain their home no issue what exists ahead.

In many cases, a combination of insurance coverage kinds may provide even more advantages than a solitary product solution, far better safeguarding your home in the event that you die all of a sudden. The equilibrium owed on your mortgage would always be covered by the mix of one or multiple life insurance coverage plans. joint mortgage protection cover. Using life insurance coverage for home loan defense can ease the danger of someone being entrusted an unmanageable monetary concern

Personalizing your insurance coverage can provide short-term defense when your home loan amount is greatest and long-term defense to cover the whole duration of the home loan. The combination technique can function within your budget, supplies versatility and can be designed to cover all home mortgage settlements. There are various methods to utilize life insurance policy to aid cover your home mortgage, whether through a combination of policies or a single policy tailored to your needs.

This policy lasts for the full regard to your mortgage (three decades). In case of your death, your family members can make use of the death advantage to either pay off the home mortgage or make continued home mortgage repayments. You purchase a whole life insurance coverage plan to give lasting protection that fits your monetary situation.

When it involves protecting your liked ones and making certain the economic safety and security of your home, comprehending home loan life insurance policy is necessary - should i get mortgage insurance. Home loan life insurance policy is a specific kind of insurance coverage developed to repay home mortgage financial obligations and associated costs in case of the borrower's death. Allow's discover the sorts of mortgage life insurance policy offered and the advantages they provide

As home loan repayments are made, the fatality advantage lowers to correspond with the brand-new amortized mortgage balance impressive. Decreasing term insurance ensures that the payment lines up with the staying home mortgage financial debt.

Cheap Insurance Mortgage Protection

Unlike reducing term insurance policy, the size of the policy does not reduce with time. The plan provides a set fatality benefit that continues to be the exact same throughout the term, no matter the impressive mortgage equilibrium. This kind of insurance is well-suited for customers that have interest-only home mortgages and intend to make certain the full home loan amount is covered in case of their death.

When it pertains to the destiny of your home mortgage after your passing, a number of aspects enter play. State and federal laws play a considerable function in identifying what occurs to your home and the home mortgage when the proprietor dies. The proprietor's actions, such as basic estate preparation, can also influence the outcome.

These laws determine the procedure and alternatives offered to the successors and recipients. It is necessary to understand the particular legislations in your jurisdiction to navigate the scenario successfully. If you have named a successor for your home in your will, that individual typically does not have to take control of your home mortgage, offered they are not co-borrowers or co-signers on the loan.

Bank Of America Borrowers Protection Plan

The decision inevitably rests with the heir.It's crucial to consider the economic ramifications for your heirs and recipients. If the thought beneficiary fails to make home loan repayments, the lending institution keeps the right to confiscate. It may be required to ensure that the successor can afford not just the home loan payments yet also the continuous expenses such as residential property taxes, house owners insurance policy, and maintenance.

In the majority of scenarios, a joint borrower is additionally a joint proprietor and will become the single owner of the home (death insurance on mortgage). This means they will assume both the possession and the mortgage obligations. It is very important to note that unless somebody is a co-signer or a co-borrower on the lending, nobody is lawfully obligated to continue settling the home loan after the customer's fatality

If no one assumes the home loan, the home loan servicer may launch foreclosure procedures. Understanding the state and federal laws, the influence on successors and beneficiaries, and the obligations of co-borrowers is vital when it comes to browsing the intricate world of home loans after the death of the debtor. Seeking lawful assistance and taking into consideration estate preparation choices can assist ensure a smoother change and secure the passions of all parties included.

Homeowners Insurance And Mortgage Insurance

In this section, we will explore the subjects of inheritance and home loan transfer, reverse home loans after fatality, and the function of the surviving partner. When it concerns inheriting a home with a superior home loan, several aspects come right into play. If your will certainly names a beneficiary to your home that is not a co-borrower or co-signer on the funding, they usually will not have to take control of the home loan.

In instances where there is no will or the successor is not called in the will, the responsibility is up to the executor of the estate. The executor should continue making home loan repayments making use of funds from the estate while the home's fate is being identified. If the estate does not have sufficient funds or possessions, it might need to be sold off to settle the home mortgage, which can produce complications for the successors.

When one consumer on a joint home loan passes away, the enduring partner normally ends up being totally in charge of the mortgage. A joint debtor is also a joint proprietor, which suggests the making it through partner becomes the sole proprietor of the residential property. If the home mortgage was obtained with a co-borrower or co-signer, the various other event is lawfully obliged to proceed making funding settlements.

It is necessary for the making it through spouse to communicate with the lending institution, comprehend their civil liberties and obligations, and explore available options to guarantee the smooth continuation of the mortgage or make required arrangements if needed. Comprehending what happens to a home loan after the fatality of the house owner is important for both the successors and the enduring partner.

When it concerns safeguarding your enjoyed ones and ensuring the payment of your home loan after your death, mortgage security insurance policy (MPI) can provide useful coverage. This type of insurance policy is specifically made to cover impressive home mortgage payments in case of the customer's fatality. Allow's discover the coverage and benefits of home loan security insurance policy, as well as important factors to consider for enrollment.

In the occasion of your fatality, the fatality benefit is paid straight to the mortgage lending institution, making sure that the exceptional car loan balance is covered. This allows your family to remain in the home without the included stress and anxiety of prospective financial hardship. One of the benefits of mortgage defense insurance policy is that it can be an alternative for people with extreme health issue that may not receive standard term life insurance.

Mortgage Protection Services

Signing up in mortgage protection insurance coverage requires careful consideration. To get home mortgage defense insurance coverage, generally, you need to enroll within a few years of shutting on your home.

By comprehending the protection and benefits of home loan security insurance, along with thoroughly examining your alternatives, you can make informed choices to protect your family's economic health even in your absence. When it involves dealing with home mortgages in Canada after the fatality of a house owner, there are details laws and laws that enter into play.

In Canada, if the departed is the single owner of the home, it comes to be an asset that the Estate Trustee named in the individual's Will certainly should manage (term mortgage insurance). The Estate Trustee will certainly require to prepare the home offer for sale and make use of the earnings to settle the staying home loan. This is necessary for a discharge of the home owner's loan agreement to be registered

Latest Posts

Burial Insurance For Over 80

Final Expense Campaign

Best Funeral Expense Insurance